Economy

Economy

|

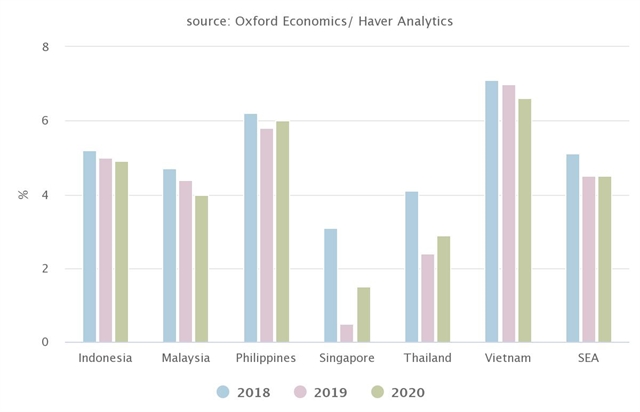

| Chart showing growth in Southeast Asia. ICEAW predicts that economic growth across the region will slow from 5.1 per cent in 2018 to 4.5 per cent in 2019 and remain unchanged in 2020. — Photo Courtesy ICEAW |

HCM CITY — Việt Nam is an exception which has benefited from some trade diversion effects caused by the trade war, according to the Institute of Chartered Accountants in England and Wales’ latest Economic Update: South-East Asia report.

Nonetheless, ICAEW added, momentum in Việt Nam was expected to ease to 6.6 per cent in 2020 from 7 per cent in 2019, given weaker Chinese import demand and increased trade protectionism.

Export-oriented economies had been the most impacted by the ongoing trade tensions, with Singapore only narrowly avoiding a technical recession in the third quarter.

Economic growth across the region was expected to slow from 5.1 per cent in 2018 to 4.5 per cent in 2019 and remain unchanged in 2020 amid high risks of a re-escalation in trade tensions.

Regional growth had slowed since 2018 and remained sluggish in the third quarter of 2019, with GDP growth across Southeast Asia rising only to 4.5 per cent year-on-year from 4.4 per cent in the second quarter.

The US-China trade conflict had been a key driver of this slowdown, with trade uncertainty remaining a key drag on manufacturing, exports and investment.

Sian Fenner, ICAEW economic advisor and Oxford Economics lead Asia economist, said: “Although there has been some progress in the talks between the US and China, friction between the two countries remains high and the bulk of imposed tariffs are unlikely to be lifted anytime soon.

"Alongside slower Chinese domestic demand, we are cautious that the outlook for regional exports and private investment will remain challenging. As such, we expect South-East Asia’s GDP growth to moderate to 4.5 per cent in 2020, remaining unchanged from 2019.”

Besides a more dovish US Federal Reserve, low inflation and a deteriorating economic outlook, regional central banks have shifted to a more accommodative stance.

The Philippines, Malaysia and Indonesia are expected to reduce interest rates by a further 25 basis points over the coming quarters, followed by an extended pause with fiscal stimulus to complement central bank efforts in cushioning the economic slowdown.

However, the room for fiscal manoeuvring will differ across the region. Most Southeast Asian economies such as Thailand and the Philippines are expected to roll out stronger fiscal impulses.

After running a series of fiscal surpluses, Singapore has the most fiscal room to ease policy. Given the highly uncertain trade environment, its government is likely to announce measures such as cash handouts and funding support for small and medium-sized enterprises in next year’s budget.

In contrast, both Việt Nam and Malaysia are constrained, given current levels of public debt.

In Malaysia, despite the announcement of a mildly expansionary budget for 2020, the government’s continued emphasis on fiscal consolidation and the risks of fiscal slippage suggest limited room for further support. — VNS