Economy

Economy

Vietnamese shares posted a strong comeback on Monday following last Friday’s slump, thanks to hopes US-China trade tensions will ease.

|

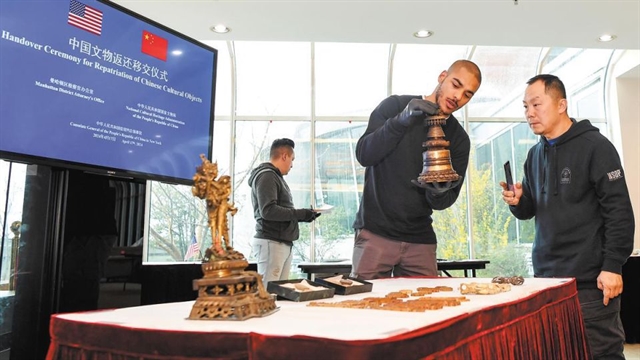

| Investors follows transactions at Sài Gòn Securities Inc (SSI) in Hà Nội. — VNS Photo Đoàn Tùng |

HÀ NỘI — Vietnamese shares posted a strong comeback on Monday following last Friday’s slump, thanks to hopes that US-China trade tensions will ease.

China and the United States agreed to a ceasefire in their bitter trade war on Saturday after high-stakes talks in Argentina between US President Donald Trump and Chinese President Xi Jinping, including no escalated tariffs on January 1. However, the longer-term outlook for trade relations remains murky.

The benchmark VN-Index on the Hồ Chí Minh Stock Exchange (HOSE) edged up 2.70 per cent to close at 951.59 points on Monday.

The index touched an all-time record high of 1,204.33 points on April 9, but then declined 23 per cent to close last week at 926.54 points.

The minor HNX Index on the Hà Nội Stock Exchange lost 24 per cent in the same period.

It rose 2.69 per cent to end at 107.64 points on Monday.

Trading liquidity rose sharply with nearly 254 million shares traded on the two local exchanges, worth VNĐ5.6 trillion (US$238 million).

Large-cap stocks continued driving the market, lifting the blue-chip VN30 Index by 3.01 per cent to 921.72 points.

Across the stock market, banks, property developers, securities firms and construction companies were among the best performing groups.

Blue chip stocks were in strong demand and pulled up the VN-Index. Bank for Investment and Development (BID) and steel maker Hoa Sen Group (HSG) hit the daily limit rise of 7 per cent.

Bank stocks led the market to a boom. Besides BID, Asia Commercial Bank (ACB), Vietinbank (CTG), HDBank (HDB), Techcombank (TCB), TPBank (TPB) and VPBank (VPB) all gained more than 4 per cent.

Petroleum was also one of the largest contributing sectors of the market. Petroleum stocks gained ground thanks to the rise in global oil prices.

World oil prices soared more than 5 per cent, a positive start after posting the weakest month in more than 10 years in November, losing more than 20 per cent as global supply outstripped demand.

Brent futures rose $2.40 to trade at $61.86 a barrel, while US crude gained $2.28 to $53.21, both on course to make their biggest daily gains in over two years.

Foreign investors were net buyers of VNĐ142.45 billion on HOSE, focusing on dairy firm Vinamilk (VNĐ86 billion), Sài Gòn Thương Tín Commercial Joint Stock Bank (VNĐ26.1 billion). In addition, they also sold a net of VNĐ16.97 billion on the HNX.

Sài Gòn-Hà Nội Securities Co (SHS) forecast that on Tuesday, the VN-Index will probably reach the 950-960 point range, and fluctuate around this range. — VNS