Economy

Economy

The HCM City Taxation Department has announced it will submit a plan for tax collection from online businesses to the City People’s Committee in early April and enact the plan in the same month.

|

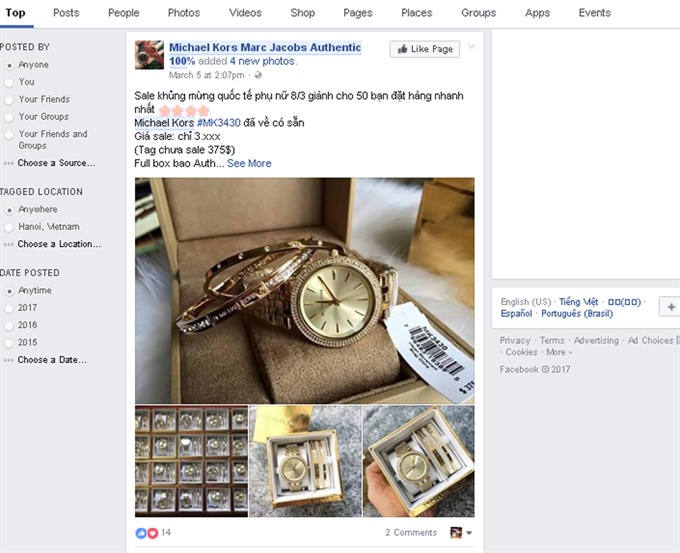

| A trading site on Facebook. - VNS Photo Thái Hà |

HÀ NỘI – The HCM City Taxation Department has announced it will submit a plan for tax collection from online businesses to the City People’s Committee in early April and enact the plan in the same month.

Local news site zing.vn quoted Lê Thị Thu Hương, deputy director of HCM City Taxation Department, as saying the department had already begun to tax internet trade and e-commerce.

"However, the draft adopted by the City People’s Committee will create a clear co-ordination mechanism and facilitate the implementation of the tax authority," she said.

The department said it would work with relevant agencies to enhance the efficiency of tax management for online sales, such as by businesses on Facebook.

Accordingly, the draft aims to strengthen co-ordination among functional agencies to provide the most complete information concerning online business.

The tax authorities have proposed collaboration between the municipal department of information and communications, department of industry and trade, network operators, banks and post offices.

The tax agency will require traders on the social network to provide information such as names, addresses, telephone numbers, and personal tax numbers so that they can oversee the businesses more closely.

They also affirmed that they would calculate tax revenue not only for sales on Facebook but also other social networks such as Instagram and YouTube.

Up to 35 per cent of businesses are selling goods and services on social networks, and there are millions of individuals and businesses selling goods on Facebook. These sales generate huge revenues, but are not paying taxes, reported the agency.

Tax collection from online trade has been a hot topic due to its complexity and difficulty to manage.

Many experts argue this tax is just for taxpayers, as many individuals selling goods on Facebook are making huge profits but not paying taxes while sellers of similar items using stores have to pay taxes.

Phạm Thành Kiên, director of HCM City department of industry and trade, said the department would sign a co-operation agreement with the taxation department to prevent tax losses.

“We have some categories to manage e-commerce or businesses on social network, but currently it is difficult to collect tax, solutions are being discussed. We have asked Facebook to work with us in tax management,” he said.

Many experts agreed that tax collection for online trading was not easy.

Thanh Niên (Young People) newspaper cited Trần Duệ, a tax expert in HCM City, as saying that those whose revenue was higher than VNĐ100 million per year must pay tax, however, it was hard for tax agencies to calculate online traders’ exact revenue.

For example, there were many transactions conducted by private message, inbox or calls, he said. There were also many ways of delivering goods not through post offices, sellers could hire carriers from services like Grabbike, Ubermoto or private delivery companies.

Or for many transactions, when both sellers and buyers did not want others to know the value of their goods, they could use their own ways of quoting prices, the expert said.

Thus, it would be difficult for tax agencies to track the revenue and quantify volume of goods sold by online businesses, said Duệ.

“Tax agencies should first test and focus on sites which have a large number of visitors before applying the rules widely”, he suggested. - VNS