Economy

Economy

Việt Nam will continue to restructure its public debt with tighter monitoring of projects as it deals with the challenge of building macro-policies to deal with the issue, Prime Minister Nguyễn Xuân Phúc said yesterday.

|

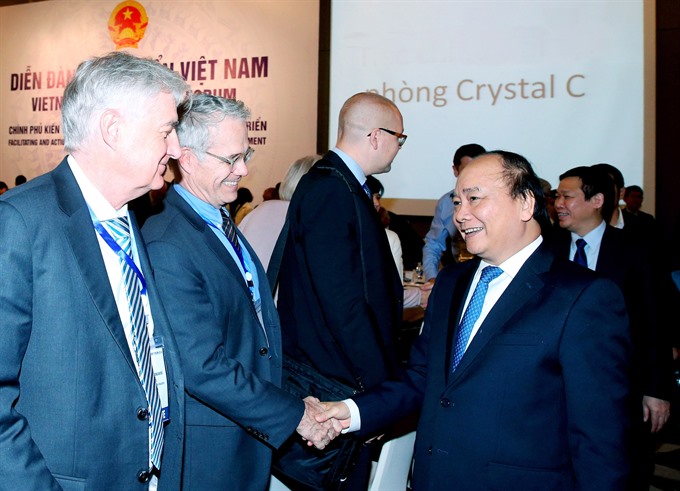

| Prime Minister Nguyễn Xuân Phúc shakes hands with the foreign delegates who attend the Việt Nam Development Forum in Hà Nội on Friday. — VNA/VNS Photo Thống Nhất |

HÀ NỘI — Việt Nam will continue to restructure its public debt with tighter monitoring of projects as it deals with the challenge of building macro-policies to deal with the issue, Prime Minister Nguyễn Xuân Phúc said yesterday.

He told the Việt Nam Development Forum in Hà Nội that the restructuring was one of the major directions that the Government will take over the next five years, as strives for action-oriented and facilitative governance to boost development.

Phúc said the Government will control projects funded by the State exechequer to ensure that they are efficient and being used for right purposes. It will also restrict issuing loan guarantees, and closely supervise debts incurred by provincial and municipal authorities.

The Government will also try to reduce loan costs, revise laws on the State Budget and public debt management, and review strategies and programmes to manage public debt in the medium term, the PM said.

A November session of the National Assembly had been told that Việt Nam’s public debt was on the rise this year and could likely cross the national red line of 65 per cent of the gross domestic product (GDP).

Finance Minister Đinh Tiến Dũng reported last month that public debt had reached VNĐ2.6 quadrillion (US$117 billion) last year, more than double that of 2010. The annual growth of public debt during 2011-15 was 18.4 per cent, triple the annual GDP growth rate, which averaged about 5.9 per cent.

Unavoidable

“A developing nation with limited resources cannot avoid [increasing] public debt for growth… It is important to control debt at a suitable level and manage it efficiently,” said Minister of Planning and Investment Nguyễn Chí Dũng.

John Panzer, Director of Global Practice for Macroeconomics and Fiscal Policy at the World Bank, said Việt Nam must improve the predictability and credibility of fiscal policies and concretise them with permanent measures for structural changes.

The country needs to accelerate development of the domestic bond market to better manage debts, he said.

Norio Saito, Deputy Country Director of the Asian Development Bank (ADB) in Việt Nam, emphasised the need for improving public asset management.

Saito said recent studies comparing capital spending and infrastructure quality across the country reveal that, on average, around 30 per cent of public investment is wasted as a result of inefficiencies.

Furthermore, a 2014 study has estimated that upgrading Việt Nam’s public financial management systems from current levels to “best practice” standards could deliver the equivalent of 22 per cent more revenue per annum.

“With Việt Nam’s fiscal space declining and public debt levels approaching their legislated limit, enhancing expenditure efficiency will be vital for improving infrastructure and service delivery and sustaining long-term poverty reduction,” Saito said.

He said the country has spent an average of 10 per cent of GDP on public infrastructure per year over the last decade – one of the highest levels in the region. Yet, while construction has progressed rapidly, approaches to managing these assets once completed has lagged.

For example, management responsibilities of public assets are currently spread across more than 100,000 government departments and divisions across the Government. Such complex agency involvement has to be streamlined, he said.

Bad debt settlement

Yesterday, PM Phúc suggested that the International Finance Corporation, a member of the World Bank, assists Việt Nam in handling bad debt – a vital issue impacting economic stability and growth.

He also said the ADB and a private Vietnamese partner were planning to acquire a fragile commercial bank in Việt Nam, but did not provide more detail.

Phúc added that the Government is trying to develop a debt trading market, and complete legal frameworks to deal with mortgages and enhance capacity of the Việt Nam Asset Management Company.

Jonathan Dunn of the International Monetary Fund said acceleration of bad debt settlement will help the credit institution system better support competitive private enterprises, and this would bolster growth prospects.

PM Phúc said other priorities for national development in the next few years will include: completing laws and institutions to facilitate production and business development; improving the business climate and local competitiveness; and restructuring the economy and renewing the nation’s growth model.

Speeding up equitisation of State utilities, guaranteeing social security and boosting international integration, especially promoting the implementation of free trade agreements, are also among the major development directions, he said. — VNS