Economy

Economy

With the combined market capitalisation of all listed companies accounting for less than 30 per cent of the country’s GDP, the Vietnamese securities market has plenty of room to grow, Trần Anh Đào, deputy director of the HCM City Stock Exchange (HOSE), said yesterday.

|

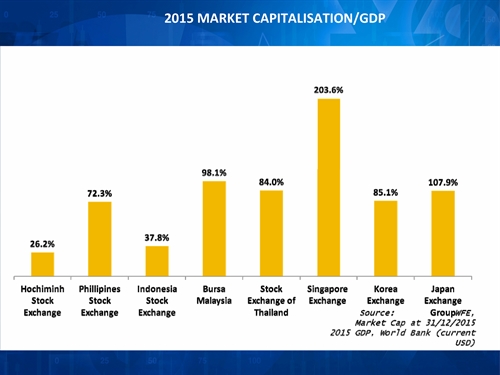

| The total market value of the HCM City stock exchange as a ratio of GDP is modest compared to regional markets. |

HCM CITY – With the combined market capitalisation of all listed companies accounting for less than 30 per cent of the country’s GDP, the Vietnamese securities market has plenty of room to grow, Trần Anh Đào, deputy director of the HCM City Stock Exchange (HOSE), said yesterday at a press meeting here.

The market cap is more than 200 per cent in Singapore and 98.1 per cent in Thailand, and Việt Nam hopes to achieve 70 per cent by 2020, according to Đào.

The restructuring of State-owned enterprises promises to bring a sizeable supply of stocks into the market.

Under new regulations, listed companies need to provide information faster and in a more transparent manner and also in English, which would improve the market’s transparency.

All these promise to attract more investors.

Recently large foreign investors visited HOSE to learn more about it and explore investment opportunities.

The country’s two stock exchanges – the other being in Hà Nội – are set to be merged as part of efforts to develop the securities market, though the schedule is undecided.

A common index was expected to be launched in October, Đào said, adding that HOSE would also inaugurate a sustainable growth index in the first quarter of next year.

According to HOSE, the bourse’s market capitalisation is VNĐ1,270 trillion (US$56.95 billion), a 13.26 per cent rise from the first quarter.

The trading value in the second quarter was worth VNĐ147.15 trillion ($6.59 billion), representing a 13 per cent increase.

Trading by foreign investors decreased in the second quarter in terms of both volume and value.

Their buying and selling represented 13.36 per cent and 13.84 per cent of the total market transactions, compared to 17.18 per cent and 17.99 per cent in the first quarter. - VNS